Table of Contents

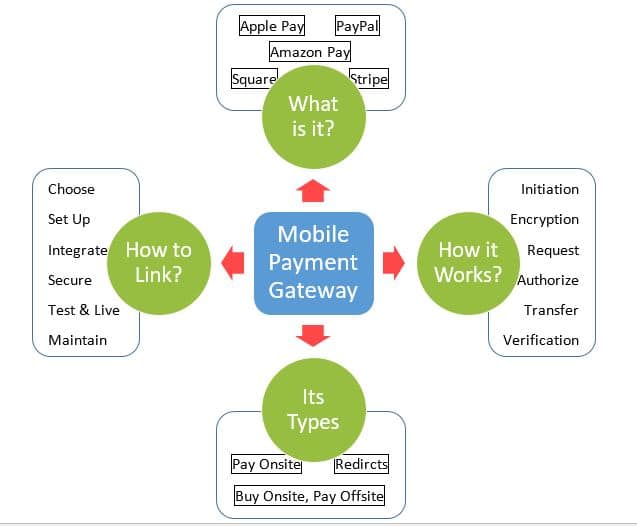

ToggleThe thing with most mobile apps today is that they offer in-app purchases or online order booking facilities. In addition, these apps provide a list of different payment options that users can select from for a specific purchase order. The question arises of how the apps ensure the security and availability of those payment options and how they work. For this, we need to understand what a mobile payment gateway is with sufficient examples and how they work.

In this blog, we will also cover the three types of payment gateways or options and the process of integrating them into an app. Businesses must consider adding strong security protocols and data protection tools like encryption to ensure safe transactions. They must also hire a credible fintech app development company to build an app or to integrate a gateway into an existing app.

What is a Mobile Payment Gateway?

As technology grew with time, the possibility of online payments via mobile apps became a vital feature of online commerce. From in-app purchases to retail orders and advertisement options to gaming tools, payment gateways make it all possible. It is a technology that facilitates mobile payments via cards, wallets, or accounts in real time, using integrations from service providers.

Besides that, it involves a series of parties and provides a platform where each party can send, receive, and authorize the transaction. The gateway serves as an intermediary between clients, merchants, app owners, businesses, and financial institutions. It not only ensures the safety and efficiency of third-party data and transactions but also allows them to manage their accounts.

The following are its key features for a deeper understanding of the underlying aspects:

- Security – Encryption, tokenization, and compliance with industry standards like PCI DSS to protect sensitive payment information.

- Speed – Fast and efficient processing to minimize delays in completing transactions.

- Multiple Payment Methods – Support for various payment options, including credit/debit or virtual cards, digital wallets, and bank transfers.

- User-Friendly Experience – Seamless integration into mobile apps and websites to ensure a smooth checkout process for users.

- Fraud Detection – Integrations with fraud prevention tools that monitor transactions for suspicious activity.

List of Best Payment Gateways for Mobile Apps

Many of us knowingly or unknowingly use payment gateways, even if we do not actually make a payment. Free subscriptions, trial versions, and even mobile banking applications involve the usage of this technology. The following is a list of the best credible and famous gateways.

Many of us knowingly or unknowingly use payment gateways, even if we do not actually make a payment. Free subscriptions, trial versions, and even mobile banking applications involve the usage of this technology. The following is a list of the best credible and famous gateways.

1. PayPal

PayPal is a famous name in the world of online payments and for good reasons. Clients strongly trust it, and it offers multiple gateway options, making it a go-to choice for many businesses. PayPal’s Payflow gateway comes in two flavors: a free checkout gateway by PayPal or a premium service for more checkout customization with a monthly fee. Both options include built-in fraud protection at no extra cost, ensuring your transactions are secure and giving you peace of mind.

2. Square

Square is both a credit card processor and a payment gateway provider, and it’s made a big name for itself. It handled an impressive $210 billion in gross payment volume solely in 2023. Square is particularly popular among small businesses that need a simple solution for in-person credit card processing. However, they do charge a bit more for manual transaction entries.

3. Stripe

If you’re in mobile eCommerce, SaaS, non-profits, or platform-based payments, Stripe is a top contender. It’s built to handle a large volume of transactions, which is why big players like Lyft use Stripe to manage payments for their massive fleet of over 700,000 drivers. Stripe’s versatility and scalability make it a favorite for businesses that need a robust payment gateway.

4. Apple Pay

For businesses focusing on mobile payments, Apple Pay is a standout option. It leverages Face ID and Touch ID for secure transactions, appealing to those who prefer to make payments through electronic wallets. With over 1 billion iPhone users worldwide—half of whom use Apple Pay—accepting this payment method can be a game-changer. Plus, many payment gateways, including PayPal, support Apple Pay, making integration seamless.

5. Amazon Pay

With 200 million Amazon Prime members globally, Amazon Pay is a gateway you don’t want to overlook. It’s not only popular but also customizable, offering several plugins, including options for BigCommerce. It allows businesses to tap into a vast customer base, making it easier to capture more sales.

How Do Payment Gateways Work?

Behind some simple taps on the mobile app and a few typing entries, there is an intricate process that does the task. We will try to explain the process thoroughly. The following is the list of steps that are executed once the purchase option leads you to a payment form.

1. Customer Initiates Payment

The process begins with the customers selecting a product or service within a mobile app or on a website and proceeds to the checkout. They choose a payment method, typically entering their card details or account information. Most of them use a digital wallet like Apple Pay or Google Pay or other alternative payment methods like PayPal or mobile banking.

2. Payment Information Encryption

The payment gateways encrypt the payment information to protect it from unauthorized access. Encryption ensures that sensitive data, such as card numbers, CVVs, and personal information, are securely transmitted.

3. Transaction Request Sent

The encrypted payment information is sent to the payment gateway, which then forwards it to the acquiring merchant’s bank. A gateway also passes the transaction details to the customer’s bank for issuance verification.

4. Authorization Process

The issuing bank verifies the customer’s payment details, checks for sufficient funds, and ensures there are no red flags of potential fraud. After verification, the bank authorizes the transaction.

5. Approval/Denial Response

The issuing bank sends an approval or denial message back to the gateway. In case of approval, the transaction proceeds to the next step. Otherwise, the customer receives a notification along with a reason for the inability to process the request.

6. Funds Transfer

Upon approval, the gateway facilitates the transfer of funds from the customer’s account to the merchant’s account through the acquiring bank. The process typically happens within a few seconds, though the actual funds transfer may take a day or two, depending on the institutions.

7. Transaction Confirmation

Finally, the customer receives a confirmation of the transaction on their mobile device, and the merchant receives a successful payment notification. Both parties receive some additional information like transaction IDs on digital receipts, allowing them to fulfill the order or service.

Types of Payment Gateways

Although there are many complex and overlapping types of payment gateways, the following are the most common ones.

1. On-Site Payments

For large businesses, on-site payments are the way to go. Here, the entire checkout experience, from selecting items to processing payments, happens directly on servers. The big advantage? Control. It is easier to manage every aspect of the user experience, which leads to significant improvements, especially for high transaction volumes. Of course, with great control comes great responsibility; you’ll need to ensure that everything runs smoothly and securely.

2. On-Site Checkout, Off-Site Payment

This type is a hybrid. The checkout process takes place on your app, but when it’s time to process the payment, it’s handled by a third party on their back end. This setup can simplify the payment process while boosting security, as the heavy lifting happens off-site. The trade-off? You lose a bit of control over user experience, so it’s crucial to choose a reliable partner to keep data safe.

3. Redirects

Redirects are another option, especially popular with smaller businesses. Here’s how it works: when it’s time to pay, your customer is sent to a third-party site like PayPal to complete the transaction. This method is super convenient because it leverages the security and reliability of big platforms without having to manage everything. The downside? You’ll have less control over the checkout experience, and customers will have to take an extra step to finish their purchase.

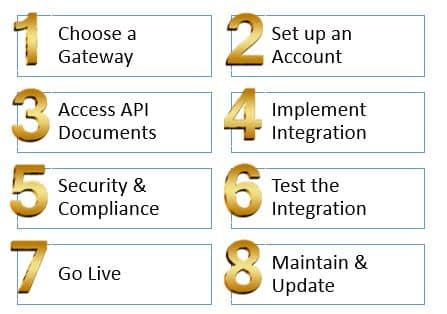

How to Integrate Them into Your App?

App integration is a topic of various debates and involves many complexities, so we recommend hiring an expert development agency. Integrating payment gateways with your app is a crucial step in enabling seamless transactions for users. Here’s a straightforward guide on how to do it:

1. Choose the Right Payment Gateway

The first step in integrating a payment gateway with your app is selecting the one that best aligns with your business needs. Begin by evaluating the volume of transactions you anticipate and the payment methods your customers may use, such as credit cards or digital wallets. Consider the compatibility of the gateway with your app’s platform, whether it’s iOS, Android, or both. Also, assess the features that it offers, including support for recurring billing and fraud detection.

2. Set Up a Merchant Account

Before you integrate the payment gateway, you need to set up a merchant account with the provider to receive payments. Some gateways, like PayPal and Stripe, simplify this by offering built-in accounts, eliminating the need for a separate setup. For others, you may need to go through an application process with a bank or a financial institution to establish an account.

3. Access API Documentation

After choosing a gateway and setting up an account, the next step is to get the API documentation that it provides. It offers instructions on how to integrate and information on making API calls, handling responses, and managing errors. Some gateways also provide Software Development Kits (SDKs), which can simplify the integration process, especially for mobile apps. They include pre-built components and libraries to handle payment processing and manage authentications.

4. Implement Payment Gateway Integration

With the API documentation, begin the actual integration of the payment gateway into your app. It involves coding the necessary functions to send payment details from your app to the gateway securely. On the front-end, it means designing the checkout process to be intuitive and user-friendly, ensuring that customers can easily provide information. On the back-end, you’ll need to manage the payment processing logic, especially if you are using an off-site method.

5. Security and Compliance

Security is a top priority when integrating a gateway, as you’ll be handling sensitive customer information. All payment data must use encryption both in transit and at rest to protect it from illicit access. Compliance with standards like the Payment Card Industry Data Security Standard (PCI DSS) is also essential. It outlines the security measures for handling information, including secure storage, data transmission, security testing, and network security.

6. Test the Integration

Before you go live, it is crucial to test your integration thoroughly. Most providers offer a sandbox environment where you can simulate transactions before processing real payments. It allows you to identify and resolve any issues before they impact users. Conduct end-to-end testing by simulating real-world scenarios, such as processing payments, handling errors, and managing refunds. Testing ensures that your integration works smoothly under all conditions.

7. Go Live

Once you complete testing and feel confident that everything is functioning correctly, you can switch your gateway to live mode. It’s important to closely monitor the initial transactions to ensure that everything is working per expectations. Use dashboards or reporting tools to track transaction data, monitor errors, and analyze performance metrics.

8. Maintain and Update

Integration is not a one-time task; it requires ongoing maintenance and updates. Providers regularly release new versions of their APIs and SDKs, along with security patches and updates. It’s important to stay up-to-date with these changes to ensure that your integration remains secure and functional. Gather user feedback to identify any pain points or areas for improvement.

Conclusion

We understand the importance of integrating a gateway into your app, but we encourage you to go through the legal requirements. Besides this, you must also emphasize the responsibility it adds with respect to data security and protection. After that, we highly recommend you find a reliable partner like Unique Software Development that has expertise in such projects.

This writing outlines the meaning of a mobile payment gateway, provides a few examples, and explains how it works. It also covers the different types of gateways and how to integrate them into your app. However, we again remind you to select a trustworthy partner that integrates APIs and builds fintech apps with technical prowess.