Table of Contents

ToggleIn today’s digital era, traditional wallets are rapidly being replaced by digital wallets, offering a convenient and secure way to manage finances. A custom software development company helps in making this replacement easier. If you are thinking about how to create a digital wallet, then don’t worry. In this article, we will explore the process of creating a digital wallet and highlight the importance of incorporating safety measures to ensure secure transactions.

What Is a Digital Wallet?

A digital wallet, also known as an e-wallet or mobile wallet, is a virtual application or service that allows individuals to securely store and manage their digital assets, including payment information, loyalty cards, tickets, and identification documents, on their smartphones or other electronic devices. It serves as a digital equivalent of a physical wallet, providing a convenient and secure way to make electronic transactions.

Digital wallets utilize encryption technology and secure authentication methods to safeguard users’ personal and financial information. They typically offer features such as contactless payments, peer-to-peer transfers, and online purchases, enabling users to make transactions quickly and easily without the need for physical cash or credit cards.

With the increasing popularity of mobile devices and the rise of digital transactions, digital wallets have become an integral part of the modern financial ecosystem, providing individuals with greater flexibility, convenience, and security in managing their digital assets.

Types of Digital Wallets

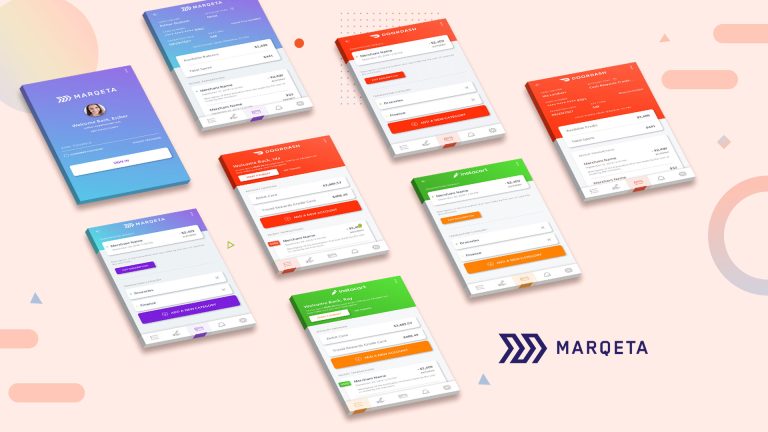

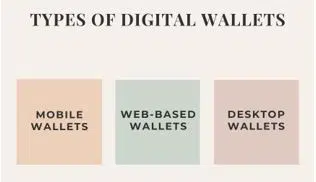

There are several types of digital wallets available to cater to different needs and preferences. Here are some common types:

1. Mobile Wallets

These wallets are specifically designed for smartphones and can be accessed through dedicated mobile apps. Some examples are Apple Pay, Google Pay, and Samsung Pay. They allow users to store payment cards, make contactless payments, and manage loyalty cards and coupons.

2. Web-Based Wallets

These wallets are accessed through web browsers and are primarily used for online transactions. Popular examples include PayPal, Skrill, and Amazon Pay. They allow users to store payment information, make online purchases, and transfer funds.

3. Desktop Wallets

These wallets are typically installed on personal computers such as desktops or laptops. They are commonly used for cryptocurrency storage and management, such as Bitcoin wallets like Electrum or Bitcoin Core.

Essential Features of a Digital Wallet

As these digital wallets continue to gain popularity, it becomes essential to understand their key features and how they enhance the user experience. When creating a digital wallet, it is crucial to consider the following features to ensure a safe and secure experience.

1. User-Friendly Interface

A digital wallet should provide a user-friendly interface and intuitive design to make transactions seamless and convenient. It should allow users to easily navigate through different options, view transaction histories, and access additional features with minimal effort. Furthermore, the inclusion of features like automatic bill payment reminders and transaction categorization can help users stay organized and in control of their finances.

2. Strong Security Measures

As digital wallets involve storing sensitive financial information, security becomes a paramount concern. A reliable digital wallet should employ robust security measures to safeguard user data and protect against unauthorized access. This includes features like strong encryption algorithms, two-factor authentication, and biometric authentication (such as fingerprint or facial recognition) for added security layers.

3. Payment Integration and Convenience

One of the primary features of a digital wallet is its ability to integrate multiple payment methods into a single platform. Whether it’s credit or debit cards, bank transfers, or even cryptocurrencies, a digital wallet should offer a seamless experience by allowing users to link and manage their various accounts in one place. This integration eliminates the need to carry multiple physical cards and simplifies the payment process, making transactions quick and convenient.

4. Transaction History and Notifications

An efficient digital wallet should provide users with a comprehensive transaction history, ensuring transparency and enabling users to keep track of their finances. Real-time notifications for transactions and account activity also enhance security.

How to Create a Digital Wallet: Step-By-Step Approach

Traditional methods of carrying physical wallets and making cash transactions are rapidly being replaced by digital wallets. Creating a digital wallet is a convenient and secure way to manage your finances and streamline your transactions. In order to know how to create a digital wallet, read the following steps carefully.

1. Determine Your Requirements

The first step in creating a digital wallet is to identify your requirements and objectives. Are you looking for a wallet primarily for making payments, or do you also want additional features such as loyalty programs, expense tracking, or investment options? Understanding your needs will help you choose the right type of wallet and prioritize the features that are important to you.

2. Choose the Right Technology

Selecting the appropriate technology stack is crucial for building a robust and secure digital wallet. Some popular technologies for digital wallet development include mobile application development frameworks like React Native or Flutter. Alternatively, you can opt for web-based solutions using technologies like Angular or React. Additionally, you will need to decide on server-side technology, such as Node.js or Java, to handle the backend operations.

3. Ensure Security

As digital wallets involve handling sensitive financial information, security should be a top priority. Implement industry-standard security measures, including encryption, secure authentication mechanisms, and data protection protocols. Comply with relevant security standards and regulations, such as Payment Card Industry Data Security Standard (PCI DSS) or General Data Protection Regulation (GDPR), depending on your target market.

4. Create User-friendly Interface

A user-friendly interface plays a crucial role in the success of a digital wallet. Design an intuitive and visually appealing user interface (UI) that allows users to navigate effortlessly and complete transactions seamlessly. Focus on providing a smooth onboarding experience, simple transaction flows, and clear notifications to enhance user satisfaction.

5. Integrate Payment Gateways

To enable seamless transactions within your digital wallet, integrate popular payment gateways and methods. Collaborate with trusted payment service providers to ensure compatibility and secure payment processing. Incorporate support for various payment options, such as credit/debit cards, bank transfers, digital currencies, or even biometric-based authentication systems for enhanced security and convenience.

6. Implement Features and Functionality

Consider the features you want to offer in your digital wallet. Apart from basic transaction capabilities, you can include additional functionalities like bill payments, fund transfers to external accounts, transaction history, expense tracking, loyalty programs, and integration with third-party services. Prioritize features that align with your target audience’s needs and preferences.

7. Test and Refine

Thoroughly test your digital wallet to identify and fix any bugs, security vulnerabilities, or usability issues. Conduct extensive testing across multiple devices and operating systems to ensure a seamless user experience. Obtain feedback from early users and make necessary refinements based on their input. Regularly update your wallet with new features, security patches, and performance enhancements to stay competitive in the market.

8. Launch and Promote

Once you are satisfied with the functionality and stability of your digital wallet, it’s time to launch it to the market. Develop a comprehensive marketing strategy to promote your wallet, leveraging digital channels, social media platforms, and partnerships with businesses and financial institutions. Offer incentives, discounts, or exclusive deals to encourage users to adopt your wallet and spread the word.

Conclusion

Creating a digital wallet is an important step toward embracing the future of financial technology. By understanding the concept of digital wallets and incorporating essential features such as strong security measures and seamless integration with payment options, users can enjoy a safe and secure FinTech solution. By following the steps outlined in this article, you now know how to create a digital wallet and unlock a world of convenient and secure financial transactions. If you want to create a digital wallet, Unique Software Development can help. Contact us today!